Wondering why IUL is a bad investment? If you’re considering an Indexed Universal Life Insurance policy, you need to understand the significant risks and drawbacks that make IUL a poor investment choice for most people. According to recent findings from the National Association of Insurance Commissioners (NAIC), IUL policies have become increasingly complex while raising concerns about consumer protection. This comprehensive guide explores why financial experts consistently warn against IULs and what alternatives might better serve your financial goals.

Table of Contents

Understanding Why IUL Is a Bad Investment Choice

Indexed Universal Life Insurance policies are aggressively marketed as the perfect blend of life insurance and investment opportunity. However, research from the Insurance Information Institute highlights multiple factors that make IUL a bad investment vehicle:

1. Excessive Fees and Charges

According to a comprehensive study by the Society of Actuaries, the complex fee structure of IUL policies creates a significant drag on returns:

- Cost of Insurance (COI) charges that increase over time

- Administrative fees eating into your premium payments

- Premium load fees reducing your actual investment amount

- Policy rider charges for additional features

- Substantial surrender charges if you need to exit early

- Index cap rate fees limiting your upside potential

2. Limited Return Potential

Analysis from FINRA’s Investor Insights reveals several factors that severely restrict your earning potential:

- Participation rates typically limit you to 50-70% of index gains

- Cap rates usually restrict annual returns to 8-10%

- No dividend returns, which Morningstar research shows historically account for 40% of total market returns

- Complex crediting methods that often result in lower-than-expected returns

3. Misleading Marketing Practices

The Consumer Financial Protection Bureau (CFPB) has identified problematic sales tactics often used when promoting IULs:

- Overly optimistic return projections

- Understated cost implications

- Complicated policy illustrations that hide true expenses

- Unrealistic scenarios that ignore market volatility

- Downplayed risks of policy lapse

The Hidden Dangers of IUL Policy Loans

According to research from the CFA Institute, the “be your own banker” concept promoted with IULs comes with serious risks:

- Variable loan interest rates that can exceed credited returns

- Reduced death benefits when loans are outstanding

- Potential tax consequences if the policy lapses

- Compound interest working against you

- Risk of forced additional premium payments

Impact of Market Conditions on IUL Performance

Recent analysis by Fidelity Investments has exposed additional reasons why IUL is a bad investment:

- Floor rates don’t fully protect against market downturns

- Insurance companies can adjust caps and participation rates

- Policy charges continue even in down markets

- Sequence of returns risk can devastate policy performance

- Limited flexibility during economic uncertainty

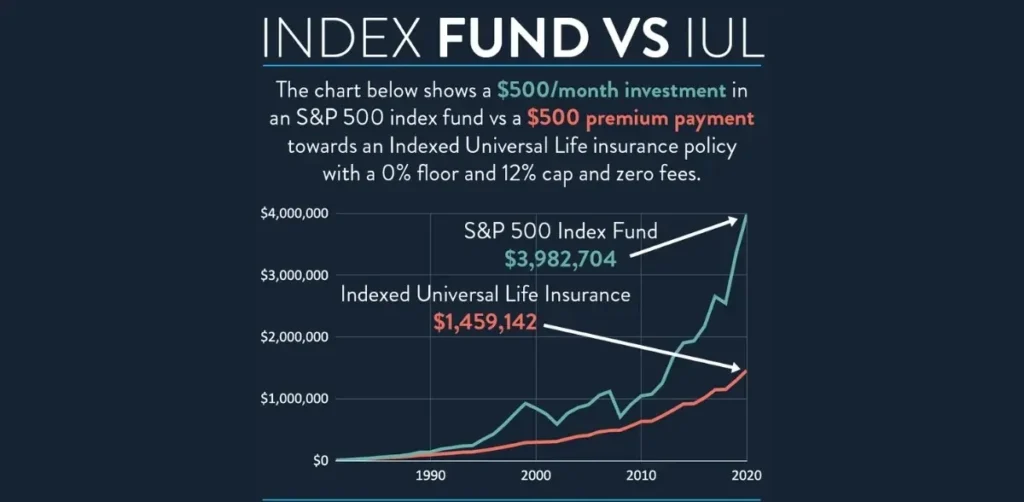

Superior Alternatives to IUL Policies

Vanguard’s investment research suggests these more effective options:

Term Life Insurance + Traditional Investments

- Purchase affordable term life coverage

- Invest the premium difference in low-cost index funds

- Maintain complete control over your investments

- Benefit from market dividends

- Avoid complex insurance charges

Traditional Retirement Accounts

- Maximize contributions to 401(k)s and IRAs

- Take advantage of employer matching

- Enjoy lower fees and simpler structures

- Benefit from true tax advantages

- Maintain better liquidity

Expert Opinions and Research

The Financial Industry Regulatory Authority (FINRA) and leading financial experts consistently warn against IULs because:

- Products are unnecessarily complex

- Historical performance falls short of projections

- High fees erode potential returns

- Policies frequently lapse before providing claimed benefits

- Better alternatives exist for both insurance and investment needs

The Mathematical Reality

Analysis by The Journal of Financial Planning reveals that IUL policies often underperform simpler investment strategies by 1-2% annually, primarily due to:

- Complex fee structures

- Capped returns

- Missing dividend income

- Policy maintenance costs

- Inefficient tax treatment in many scenarios

Making an Informed Decision

The Securities and Exchange Commission (SEC) recommends considering these factors before purchasing an IUL:

- Separate insurance from investments for better results

- Focus on low-cost, transparent financial products

- Maintain flexibility with your investment strategy

- Consider the long-term impact of fees

- Work with a fee-only financial advisor

[Internal Link]Explore better investment alternatives for your financial goals[/Internal Link]

Conclusion

Understanding why IUL is a bad investment is crucial for making sound financial decisions. While these policies may seem attractive initially, their combination of high costs, limited returns, and complex structures makes them poor choices for most investors. As supported by research from the American College of Financial Services, focusing on straightforward solutions like term life insurance combined with traditional investments often leads to better financial outcomes.

Consider consulting with a fee-only financial advisor who can provide unbiased advice based on your specific situation before making any major insurance or investment decisions.

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides.