When you spend money, you are making choices that directly impact your financial well-being. Whether you’re purchasing everyday items or big-ticket purchases, every dollar spent can either support your financial goals or derail them. In this article, we’ll explore how to make smarter decisions, manage your spending, and ultimately improve your financial health.

Table of Contents

Understanding the Impact of Spending Money

When you spend money, it’s more than just an exchange for goods and services—it reflects your values, priorities, and habits. Developing awareness about how you spend can help you make more intentional financial decisions.

Many people fall into the trap of emotional spending. Whether due to stress, peer pressure, or boredom, emotions often influence our buying decisions. This is why understanding the psychological triggers behind your purchases is critical to taking control of your finances.

The Psychology Behind Spending Money

When you spend money impulsively, it’s often linked to emotional responses. For instance, some people find comfort in shopping when feeling anxious, while others may overspend to keep up with social expectations. Recognizing these triggers can help you avoid falling into unhealthy financial patterns.

One way to combat emotional spending is by taking a moment to reflect on whether the purchase aligns with your long-term financial goals. Ask yourself: Is this purchase necessary right now? Can it wait?

The Power of Budgeting: Track Your Spending

Budgeting is the cornerstone of smart spending. When you spend money, having a clear budget helps you avoid overspending and ensures that you’re allocating funds to your most important financial goals.

Why Budgeting is Essential When You Spend Money

A well-structured budget can give you a clear picture of where your money is going each month. By tracking income and expenses, you can identify areas where you can cut back and where you may need to increase your spending.

For example, if you’re spending more than you earn or using credit cards to fund unnecessary purchases, a budget will highlight these issues and help you make necessary adjustments.

Here’s a basic structure for a monthly budget:

- Income: Total monthly income after taxes

- Fixed Expenses: Rent, utilities, insurance

- Variable Expenses: Groceries, transportation, entertainment

- Savings/Investments: 10-20% of your income should go to savings or investment accounts

- Debt Payments: Prioritize paying down high-interest debt first

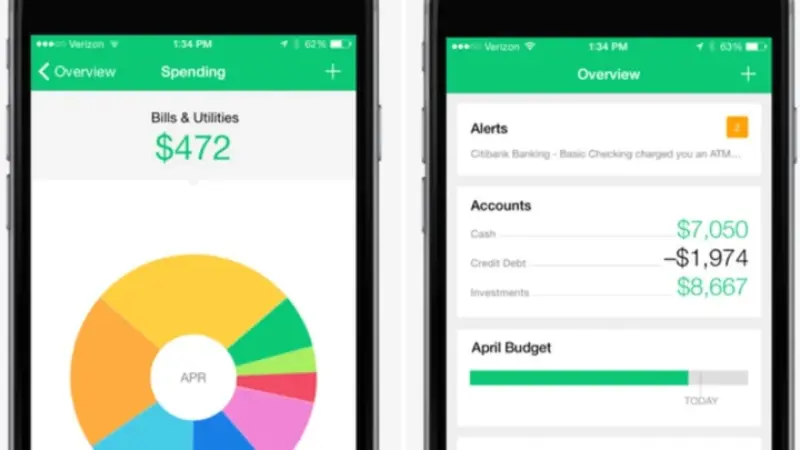

Tracking Your Spending

In addition to having a budget, actively tracking your spending is just as important. Many people overspend because they don’t realize where their money is going. Modern tools, like budgeting apps or spreadsheets, allow you to categorize your purchases and track your progress in real time.

Avoiding Impulse Purchases: Stay in Control of Your Spending

One of the main obstacles to financial success is impulse buying. Impulse purchases can quickly add up, leading to an unhealthy financial situation. When you spend money impulsively, it’s often due to lack of planning or the influence of marketing and social pressures.

How to Combat Impulse Purchases

To avoid impulse buys:

- Wait Before Purchasing: Give yourself a cooling-off period. If you see something you like but don’t need, walk away and wait 24-48 hours before making the purchase. Chances are, you’ll realize you don’t need it.

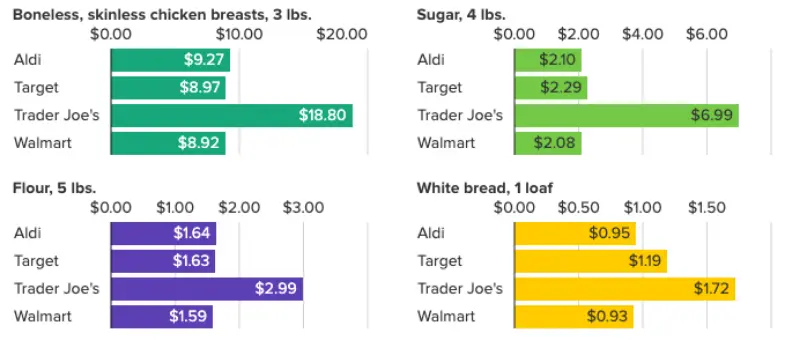

- Create a Shopping List: Before going shopping, make a list of what you need and stick to it. This helps you stay focused on your actual needs, not wants.

- Unsubscribe from Marketing Emails: Many online retailers send daily emails that tempt you with discounts. Unsubscribing from these can reduce the temptation to spend unnecessarily.

Smart Spending Strategies

Focus on Your Financial Priorities

When you spend money, make sure it aligns with your financial goals. It’s easy to get distracted by flashy ads, but when you’re focused on your long-term objectives—like saving for a home, a car, or retirement—every purchase must support that goal.

If your goal is to save, focus on cutting down on non-essential spending. Simple actions, like cooking meals at home instead of dining out, can help you save significantly in the long run.

Save Before You Spend

Another effective strategy is to pay yourself first. Before you start spending, set aside a portion of your income for savings or investments. Automating your savings—whether for an emergency fund, retirement, or future goals—ensures that you’re building your financial foundation before you spend on discretionary items.

The Role of Debt in Spending Decisions

Debt can have a significant influence on how you spend money. If you’re constantly using credit to fund your purchases, you’re not truly spending your own money. This can lead to a cycle of debt that’s difficult to escape.

How Debt Impacts Spending Habits

When you spend money on credit, you’re essentially borrowing from your future income. If you’re not careful, credit card debt can accumulate rapidly due to high-interest rates. While it may seem convenient to buy now and pay later, this approach can lead to significant financial strain if not managed properly.

Instead of using credit to fund non-essential purchases, work on building an emergency fund so that you have a safety net for unexpected expenses. If you’re already in debt, prioritize paying off high-interest debt first. This will free up your financial resources and allow you to save and invest for the future.

Building Wealth While You Spend Money

Investing for the Future

When you spend money, it’s important to think about how to make your money work for you in the long term. One of the most effective ways to do this is by investing.

Investing, whether in stocks, bonds, or mutual funds, allows you to grow your wealth over time. While there is risk involved, starting early gives you more time to ride out market fluctuations and take advantage of compound interest.

Here are a few investment options:

- Stocks: High-risk, high-reward options.

- Bonds: More stable, lower-risk investments.

- Mutual Funds: Diversified portfolios managed by professionals.

- Real Estate: Investing in property can be a stable, long-term investment.

Start Saving for Retirement Early

The earlier you start saving for retirement, the more you benefit from compound growth. Consider contributing to a 401(k) or IRA, especially if your employer offers matching contributions. This is essentially free money for your retirement.

Conclusion: When You Spend Money, Be Strategic

When you spend money, it’s important to do so with intention. By budgeting, avoiding impulse purchases, and focusing on long-term goals, you can ensure that your spending habits align with your financial aspirations. Implementing smart spending strategies today can set you up for a brighter, more secure financial future.

By taking control of your finances and making informed spending decisions, you’ll be better equipped to avoid debt, save for the future, and build wealth over time.

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides.