Are you tired of the stress that comes with living paycheck to paycheck? You’re not alone. Nearly 64% of Americans struggle to stop living paycheck to paycheck, but with the right strategies and commitment, you can break free from this cycle. This comprehensive guide will show you proven methods to stop living paycheck to paycheck and build lasting financial stability.

Table of Contents

Why People Struggle to Stop Living Paycheck to Paycheck

Understanding the root causes of living paycheck to paycheck is crucial for breaking the cycle. Common factors that keep people trapped include:

- Insufficient emergency savings

- High fixed expenses relative to income

- Unplanned spending and poor budgeting habits

- Rising cost of living without corresponding income increases

- High-interest debt payments

Your Step-by-Step Plan to Stop Living Paycheck to Paycheck

1. Track Every Dollar to Break the Paycheck-to-Paycheck Cycle

The foundation of stopping the paycheck-to-paycheck lifestyle is understanding where your money goes. Begin by tracking every expense for 30 days, categorizing them as:

- Essential fixed expenses (rent/mortgage, utilities, insurance)

- Variable necessities (groceries, gas, healthcare)

- Non-essential spending (entertainment, dining out, subscriptions)

2. Build Your Financial Buffer

To stop living paycheck to paycheck, you need a financial cushion. Here’s how to build one:

- Set an initial goal of $1,000 for immediate emergencies

- Gradually increase to cover 3-6 months of essential expenses

- Keep these funds in a separate, easily accessible savings account

- Establish automatic transfers on payday

3. Optimize Essential Expenses to Break Free from Paycheck-to-Paycheck Living

Your fixed expenses likely consume the largest portion of your income. Consider these strategies:

Housing Costs

- Evaluate more affordable neighborhoods

- Consider sharing living spaces

- Refinance your mortgage when rates are favorable

- Negotiate during lease renewal

Transportation

- Compare insurance providers yearly

- Use public transportation when possible

- Maintain vehicles properly

- Consider reducing to one vehicle

4. Increase Your Income to Stop the Paycheck-to-Paycheck Cycle

Breaking free often requires earning more. Consider these approaches:

Immediate Solutions

- Request a raise with documented achievements

- Take on overtime opportunities

- Launch a side business

- Sell unused items

Long-term Strategies

- Invest in additional education

- Develop high-demand skills

- Build passive income streams

- Start a small business

5. Smart Debt Management for Breaking the Paycheck-to-Paycheck Pattern

High-interest debt can perpetuate living paycheck to paycheck. Take these steps:

- Create a comprehensive debt inventory

- Implement the debt avalanche method

- Investigate balance transfer opportunities

- Consider debt consolidation options

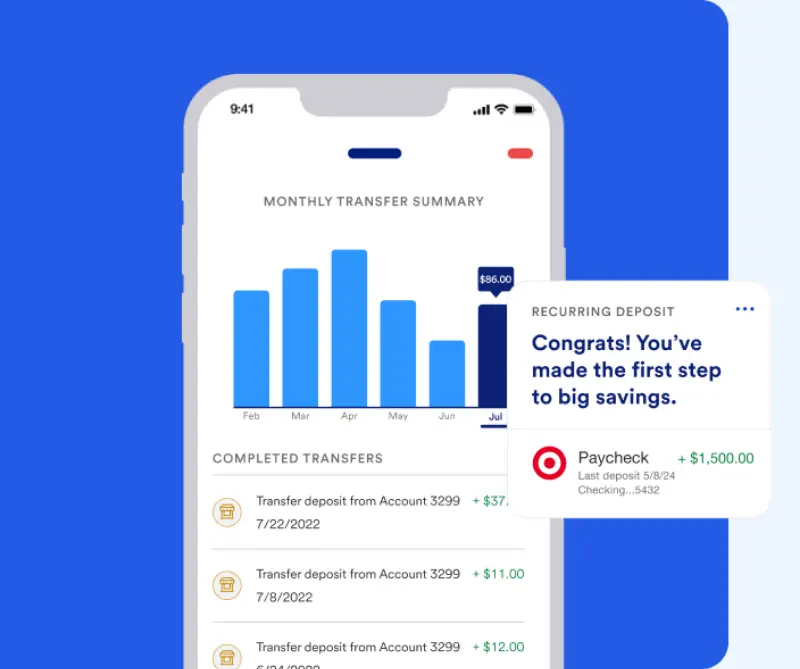

6. Automate Your Finances

Automation helps ensure consistent progress in stopping the paycheck-to-paycheck cycle:

- Set up automatic bill payments

- Create automatic savings transfers

- Use round-up features

- Schedule regular debt payments

7. Transform Your Shopping Habits

Small changes can lead to significant savings:

- Use cashback apps strategically

- Plan meals and grocery lists

- Implement a waiting period for purchases

- Compare prices across retailers

Building Long-term Financial Stability

Create Multiple Income Streams

Diversifying your income is crucial to stop living paycheck to paycheck:

- Investment dividends

- Rental property income

- Online business revenue

- Freelance work

- Passive income sources

Invest in Your Future

While working to stop living paycheck to paycheck, focus on long-term planning:

- Maximize retirement contributions

- Open and fund an IRA

- Invest in low-cost index funds

- Utilize tax-advantaged accounts

Maintaining Freedom from the Paycheck-to-Paycheck Lifestyle

Once you’ve broken free from living paycheck to paycheck, maintain your progress by:

- Conducting regular budget reviews

- Maintaining frugal habits

- Continuing financial education

- Sharing knowledge with family

Conclusion: Your Journey to Stop Living Paycheck to Paycheck

Breaking free from the paycheck-to-paycheck cycle requires dedication and strategic planning, but it’s achievable. By following these steps and maintaining consistency, you can create lasting financial stability and security. Remember that every small step toward stopping the paycheck-to-paycheck lifestyle brings you closer to financial freedom.

Stay committed to your goals, celebrate your progress, and remember that the habits you build while working to stop living paycheck to paycheck will serve you throughout your financial journey.

External Resources:

- Consumer Financial Protection Bureau’s Guide to Building Financial Security

- National Foundation for Credit Counseling

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides