Saving my family money has become more essential than ever in today’s economy. As prices rise across the board, many families are looking for ways to cut back and make their income stretch further. By adopting practical strategies, you can make significant savings without drastically altering your lifestyle. Whether it’s reducing your monthly bills, optimizing grocery shopping, or eliminating unnecessary subscriptions, there are numerous ways to save money that will add up over time. Let’s explore seven simple yet effective strategies for saving money and improving your family’s financial health.

Table of Contents

1. Track and Manage Your Household Budget

When it comes to saving my family money, the first step is understanding exactly where that money is going. Tracking your household budget is essential for identifying unnecessary expenses and areas where you can save.

- Use Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), and EveryDollar can help categorize and track your spending. These tools sync with your bank accounts to give you a detailed overview of your finances.

- Set Realistic Goals: After reviewing your spending habits, set clear and realistic goals. This might be saving for a family vacation, building an emergency fund, or paying down debt.

- Review Regularly: Monitor your budget weekly to ensure that you’re staying on track. Adjust as necessary to stay within your limits.

Pro Tip: Even small lifestyle changes—like cooking more meals at home or canceling unused subscriptions—can make a big difference in saving my family money over time.

2. Reduce Energy Consumption and Lower Utility Bills

Utility bills can take a substantial chunk out of your family’s monthly budget. By adopting energy-saving habits, you can reduce these costs and save money.

- Switch to Energy-Efficient Appliances: Upgrading to Energy Star-rated appliances and installing energy-efficient light bulbs can help lower electricity consumption.

- Unplug Electronics: Many electronics use energy even when they’re turned off. Unplug devices or use power strips to easily disconnect them when not in use.

- Seal Leaks and Insulate: Proper insulation and sealing air leaks around windows and doors can reduce heating and cooling costs, making your home more energy-efficient.

3. Shop Smarter for Groceries

Grocery shopping is often one of the largest household expenses, but with a little planning, you can save a lot of money on food.

- Create a Meal Plan: Planning your meals for the week can help you stick to a shopping list and avoid purchasing unnecessary items. Meal planning also minimizes food waste.

- Take Advantage of Sales: Look for discounts, coupons, and sales. Using grocery store apps like Target’s Cartwheel or store loyalty programs can help you save on regular items.

- Buy in Bulk: Purchasing staples like rice, pasta, and canned goods in bulk can save money in the long run, provided you have the storage space.

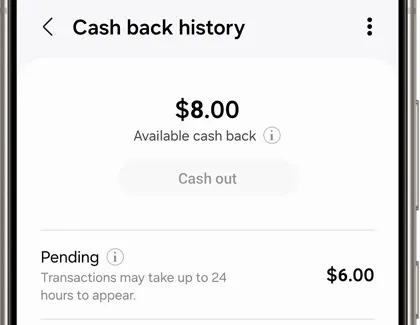

4. Use Cashback and Reward Programs

Taking advantage of cashback and reward programs is an easy way to save my family money while making purchases.

- Cashback Apps and Credit Cards: Apps like Rakuten and Ibotta offer cashback on grocery and online purchases. Pair these with cashback credit cards to maximize your savings.

- Sign Up for Loyalty Programs: Many stores offer loyalty programs that reward you with points, discounts, or exclusive deals.

- Check for Price Adjustments: Some retailers or apps like Honey automatically check for price drops after you purchase and refund you the difference if a better price is found.

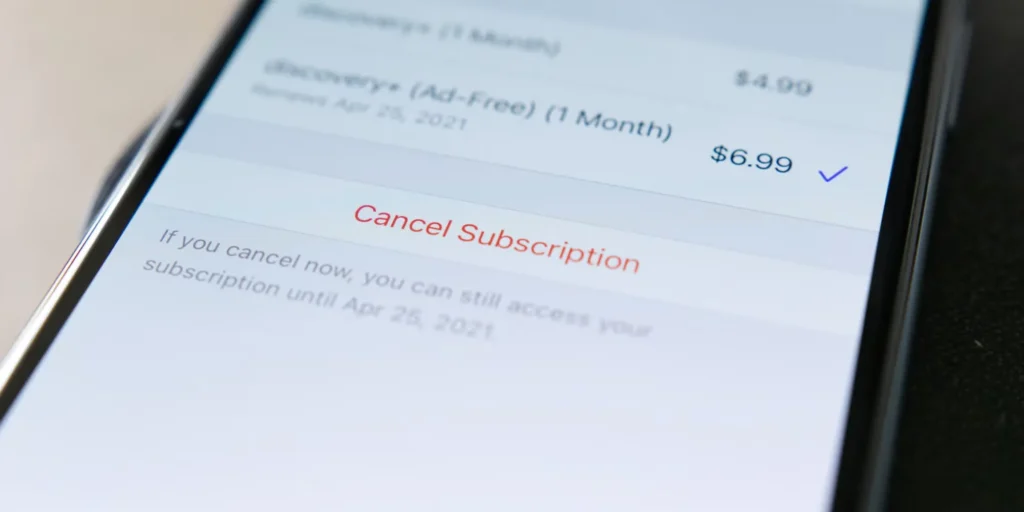

5. Cut Down on Subscriptions and Memberships

Monthly subscriptions and memberships can silently drain your finances. By auditing your subscriptions, you can easily reduce unnecessary expenses.

- Audit Your Subscriptions: List all your recurring charges, from streaming services to gym memberships. Cancel any services you no longer use or need.

- Share Family Plans: Take advantage of multi-user or family plans for services like Netflix, Spotify, and gym memberships to split costs among multiple people.

- Seek Alternatives: If you’re paying for services you rarely use, consider free or less expensive alternatives. For example, instead of paying for a premium cable package, explore free streaming services like YouTube or network TV apps.

6. Negotiate Bills and Shop for Better Deals

Often, saving my family money comes down to negotiating your bills and shopping around for better deals on essential services.

- Negotiate Your Rent or Mortgage: If you’ve been living in the same home for a while, try negotiating your rent or mortgage rate. Landlords and lenders may be willing to offer lower rates, especially if you have a good payment history.

- Compare Insurance Rates: Shop around for auto, home, and health insurance. Use comparison websites like The Zebra or Policygenius to find the best deals.

- Switch Cell Providers: Look for better cell phone deals, or consider bundling your internet, phone, and cable services for a discount.

7. Build an Emergency Fund to Avoid Future Financial Stress

Building an emergency fund is one of the most important steps in saving my family money in the long run.

- Set a Goal: Aim to save three to six months’ worth of living expenses to cover unexpected costs, such as medical bills or car repairs.

- Automate Savings: Set up automatic transfers from your checking account to a high-yield savings account to make saving easier.

- Cut Back Temporarily: If you’re struggling to build your emergency fund, consider temporarily cutting back on non-essential expenses, like entertainment, dining out, or luxury items, until your fund is more substantial.

Final Thoughts on Saving My Family Money

Saving my family money is not about making extreme sacrifices, but rather about adopting smart, sustainable habits. By tracking your spending, reducing utility bills, shopping strategically, and cutting unnecessary subscriptions, you can free up more cash for savings and investments. These strategies, along with building an emergency fund and negotiating bills, will not only help reduce your household expenses but also improve your financial security in the future.

Frequently Asked Questions (FAQs)

1. How can I start saving money with a tight budget? Start by tracking all your spending to see where your money is going. Cut back on non-essential items, prioritize saving, and set realistic financial goals.

2. What are some simple ways to reduce grocery bills? Plan your meals ahead of time, create a shopping list, and stick to it. Use coupons and take advantage of sales, and buy in bulk when it makes sense.

3. How can I reduce my monthly utility bills? Switch to energy-efficient appliances, unplug electronics when not in use, and make sure your home is well-insulated to reduce heating and cooling costs.

4. Are cashback apps worth it? Yes! Cashback apps like Rakuten and Ibotta can help you earn money back on purchases you make regularly, and pairing them with cashback credit cards maximizes your savings.

5. Can I negotiate my rent or mortgage? Yes, it’s possible! If you’ve been a good tenant or homeowner, you may be able to negotiate lower rent or refinancing options to lower your monthly payments.

6. What should be included in my emergency fund? Your emergency fund should cover three to six months’ worth of living expenses, including rent, utilities, and groceries, to protect you in case of unexpected costs.

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides.