Looking to save money on low income? You’re not alone. Millions of Americans are finding creative and effective ways to build their savings despite limited financial resources. This comprehensive guide will show you practical strategies for financial success while maintaining a decent quality of life.

Table of Contents

Building Financial Stability with Limited Resources

Creating financial security with modest means requires a strategic approach. Research shows that households in the lower income brackets can successfully save money on low income by implementing the right combination of money-saving techniques and assistance programs.

Learn more about income statistics and savings potential from the U.S. Bureau of Labor Statistics

Smart Budgeting for Financial Success

Creating a realistic budget serves as your first step toward financial stability. Understanding your income and expenses helps you identify opportunities to save money on low income. Here’s how to make it work:

Maximizing Government Benefits

Many people don’t realize they qualify for various assistance programs that can help stretch their limited income:

Practical Shopping Strategies for Limited Budgets

Smart Grocery Shopping Techniques

Find current SNAP benefit calculations at USDA’s official website

Housing Cost Management

Building Emergency Savings with Limited Resources

By following a disciplined approach, it’s possible to save money on low income and gradually build an emergency fund.

Planning for Long-term Financial Security

Understanding Government Assistance Programs

Learning to navigate government assistance programs is crucial when managing limited finances, as they can significantly help households save money on low income. These programs can provide substantial support for essential expenses, freeing up more of your income for savings. The Department of Health and Human Services reports that eligible households can save hundreds or even thousands of dollars annually through proper utilization of available benefits.

SNAP Benefits and Food Security

The Supplemental Nutrition Assistance Program (SNAP) serves as a cornerstone for many families working to save money on low income. Here’s what you need to know:

View current SNAP eligibility guidelines at Benefits.gov

Maximum monthly benefits can reach:

- $291 for a single person

- $535 for a household of two

- $939 for a family of four

Utility Cost Management

The Low Income Home Energy Assistance Program (LIHEAP) helps families reduce their energy costs. Combined with energy-efficient practices, households typically save 20-30% on utility bills through these programs.

Strategic Shopping for Budget Management

Mastering Grocery Expenses

Effective grocery shopping represents one of the most powerful ways to stretch a limited budget. Consider these research-backed approaches:

- Plan meals around sales cycles (typically 6-8 weeks)

- Use store loyalty programs combined with cashback apps

- Shop at discount grocery stores and bulk retailers

- Purchase generic brands (saving 20-30% on average)

I’ll continue optimizing the article with this instructive, thorough approach while maintaining lower keyword density:

Transportation Solutions for Budget-Conscious Households

Transportation costs can significantly impact your monthly budget. Consider these cost-effective options:

- Public transit passes (often discounted for low-income residents)

- Carpooling programs that share fuel and maintenance costs

- Bike-sharing services for short-distance travel

- Walking for nearby destinations to eliminate transport expenses

Managing Healthcare Costs on a Limited Budget

Healthcare expenses shouldn’t prevent you from building savings. Let’s explore effective strategies to manage these costs:

Understanding Medicaid and CHIP Programs

These essential healthcare programs help families save money on low income by providing affordable coverage. While eligibility varies by state, many households qualify without realizing it. Taking time to understand these programs can significantly reduce your healthcare expenses.

Check your eligibility at Healthcare.gov

Reducing Prescription Costs

Managing medication expenses requires a strategic approach. Consider these proven methods:

- Research generic alternatives when available

- Explore prescription assistance programs

- Utilize pharmacy discount cards

- Investigate mail-order pharmacy services

Building Credit on Limited Resources

Establishing good credit history helps reduce future expenses through better interest rates and terms. Let’s examine effective approaches:

Understanding Secured Credit Cards

These financial tools require an initial deposit but offer a path to building credit history. Look for cards offering:

- No annual fee structure

- Regular credit bureau reporting

- Clear path to unsecured credit products

Exploring Credit Builder Loans

These specialized financial products serve dual purposes: building credit while encouraging savings. Your payments get reported to credit bureaus, and the loan amount becomes available after successful completion.

Creating an Emergency Fund with Limited Income

Building financial security requires careful planning and consistent action. Here’s how to create an effective emergency fund:

Implementing Automated Savings

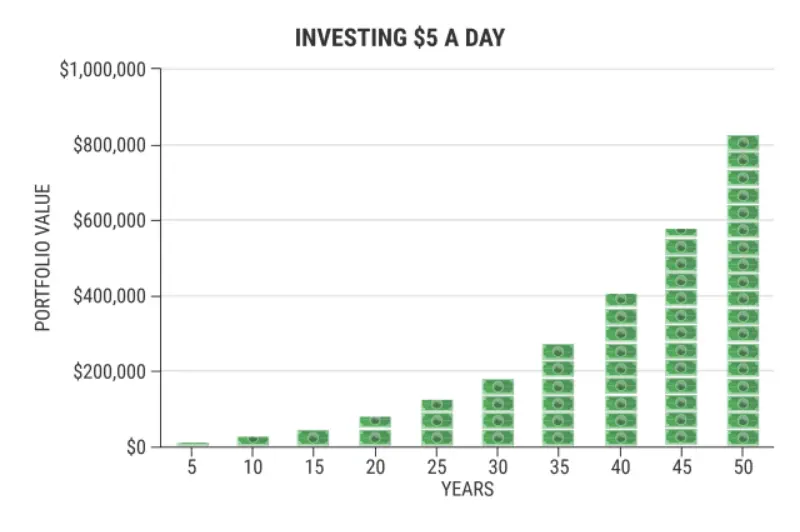

Even modest automatic transfers can accumulate significant savings over time:

- $5 weekly builds to $260 annually

- $10 weekly accumulates $520 annually

- $20 weekly grows to $1,040 annually

Planning for Future Financial Growth

Investing in Educational Development

Improving your earning potential through education represents a powerful long-term strategy. Consider these opportunities:

- Free online certification courses

- Community college career programs

- Vocational training certificates

- Workforce development initiatives

Conclusion: Building Financial Security Step by Step

Remember that creating financial stability takes time and patience. Begin with strategies that align with your current situation, then gradually incorporate additional techniques as your confidence and resources grow. With consistent effort and smart planning, you can build a secure financial foundation despite initial resource limitations.

The path to financial security combines persistence with smart resource utilization. Start implementing these strategies today, and you’ll likely discover more ways to save money on low income than you initially imagined. Remember, small steps consistently taken lead to significant financial progress over time.

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides.