How to budget money on low income is a question many face, especially when money is tight. With careful planning and some strategic choices, you can successfully manage your finances, even on a limited budget. Budgeting money on low income may seem like an overwhelming task, but it is completely achievable with the right approach. This guide will provide you with actionable tips and practical steps to take control of your finances, make your money go further, and achieve your financial goals, no matter your income level.

Table of Contents

Why Budgeting on Low Income is Crucial

Learning how to budget money on low income is not only important but necessary. Without a budget, it’s easy to overspend and get stuck in debt. Proper budgeting allows you to:

- Control your spending

- Prioritize essential expenses

- Save for emergencies

- Work toward long-term financial stability

When you understand how to budget money on low income, you can ensure that every dollar you earn is being used wisely.

1. Create a Detailed Budget Plan

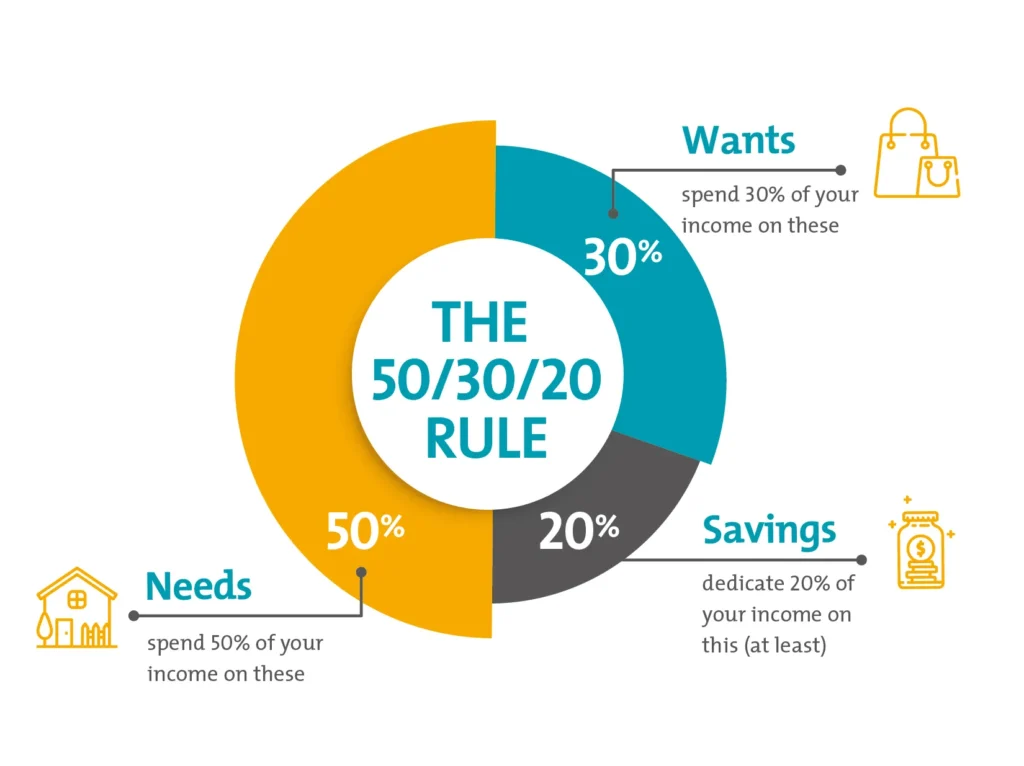

The first step in mastering how to budget money on low income is to create a detailed budget. You can’t manage your money if you don’t know where it’s going. Start by identifying your income and expenses. A great place to begin is by applying the 50/30/20 rule, which divides your budget into three main categories:

- 50% for Needs: Rent, utilities, groceries, transportation, etc.

- 30% for Wants: Entertainment, eating out, shopping, etc.

- 20% for Savings & Debt Repayment: Savings, credit card payments, etc.

This system ensures that essential expenses are covered while still allowing for savings—even on a limited income.

2. Track Every Expense

Tracking your spending is an essential part of learning how to budget money on low income. The more aware you are of where your money is going, the better decisions you can make. You may be surprised to find out where you’re overspending. Whether it’s on small purchases like coffee or larger ones like subscriptions, tracking your expenses will help you identify areas to cut back.

Use budgeting apps like Mint, EveryDollar, or You Need a Budget (YNAB) to track your expenses in real time. These tools make it easy to categorize spending and stay within your budget. Alternatively, a simple spreadsheet or even a pen-and-paper method can work just as well.

3. Prioritize Needs Over Wants

One of the most effective ways to learn how to budget money on low income is by distinguishing between needs and wants. Needs are essential for survival and daily living (e.g., housing, food, utilities), while wants are non-essential (e.g., entertainment, shopping, dining out).

When money is tight, it’s crucial to focus on meeting your basic needs before splurging on wants. This might mean cutting back on things like online shopping, dining out, or even canceling certain subscriptions. By reallocating funds to your necessities first, you will ensure that you can make ends meet.

4. Cut Back on Fixed Expenses

Fixed expenses like rent, utilities, and insurance often take up a significant portion of a budget. But there are ways to reduce these costs. Here are some suggestions for cutting back:

- Negotiate Bills: Contact your internet, cable, or insurance companies to negotiate better rates or find discounts for loyal customers.

- Downsize Housing: Consider moving to a smaller apartment, renting a room, or finding a roommate. Reducing housing costs can make a big difference in your budget.

- Shop for Better Deals: Look for cheaper alternatives for recurring bills like insurance or cell phone plans. Comparison shopping can help you save money over time.

Even small adjustments to fixed expenses can significantly impact your overall budget.

5. Eliminate or Reduce Debt

If you’re trying to figure out how to budget money on low income, paying down high-interest debt should be a priority. Credit card interest, payday loans, and other high-interest debts can eat up a large portion of your income, making it difficult to save or cover other expenses.

Start by focusing on the debt with the highest interest rate, such as credit cards. Use the debt avalanche method to pay off the most expensive debt first. Once you’re debt-free, you’ll have more money to put toward savings and other financial goals.

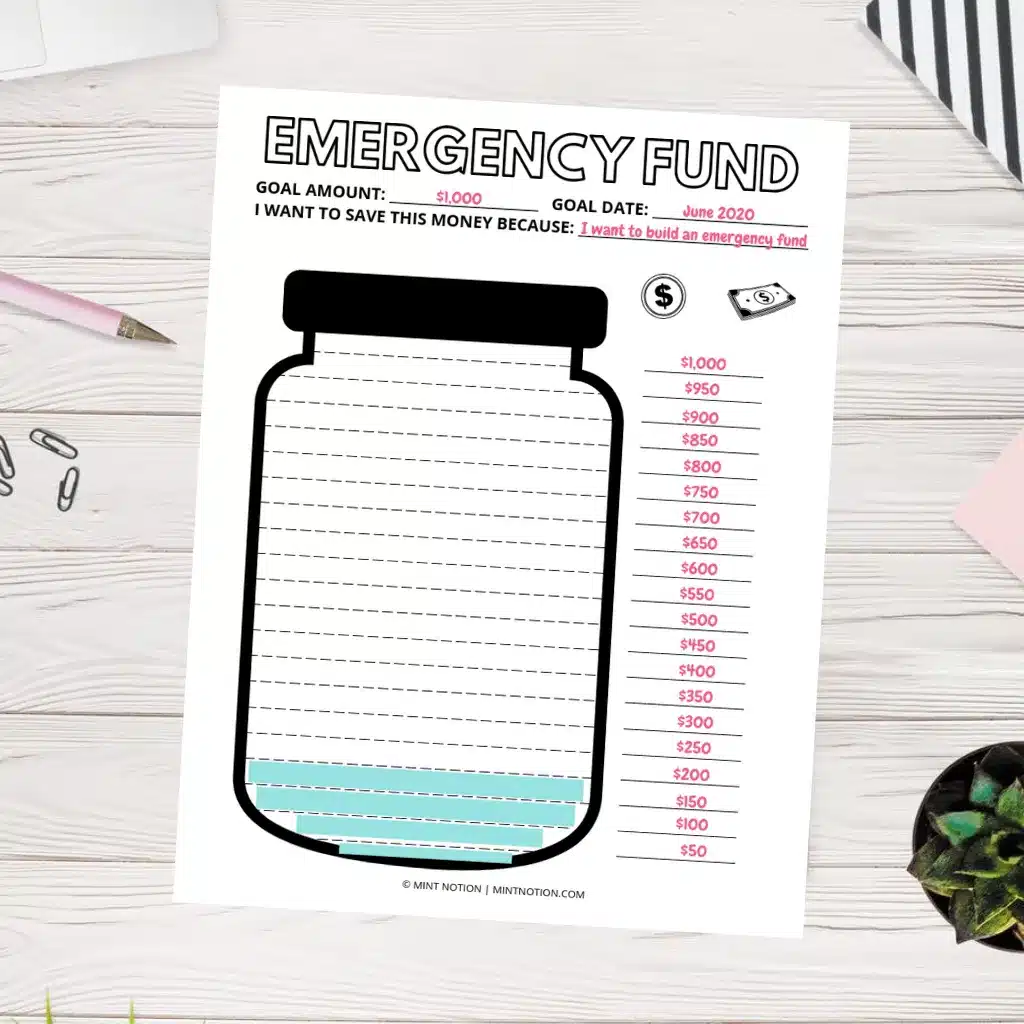

6. Start Building an Emergency Fund

An emergency fund is essential for financial security, even when you’re living on a low income. Unexpected expenses, such as car repairs or medical bills, can quickly derail your finances if you’re unprepared.

Start small by saving a set amount each month, even if it’s just $10 or $20. Over time, these small contributions will build up, and you’ll have a cushion to fall back on when life throws you a curveball.

7. Save on Groceries and Household Items

When you’re living on a tight budget, groceries and household items can quickly become a large portion of your spending. However, there are ways to save on food and everyday items without sacrificing quality:

- Meal Planning: Plan your meals for the week ahead. This way, you only buy the ingredients you need and avoid impulse purchases.

- Buy in Bulk: Purchase non-perishable items like pasta, rice, and canned goods in bulk to save money in the long run.

- Use Cashback and Coupon Apps: Apps like Ibotta, Rakuten, and Honey offer cash-back rewards and discounts when you shop.

Implementing these strategies will help you stretch your grocery budget further.

8. Find Affordable Housing Options

Housing is often the largest expense, but there are ways to reduce this cost:

- Move to a Cheaper Area: If possible, consider relocating to a place with a lower cost of living.

- Rent a Room: Renting a room in a shared apartment or house can be a much cheaper alternative to renting an entire apartment.

- Apply for Housing Assistance: Look into government housing programs designed for low-income individuals or families.

By exploring these options, you can significantly reduce your housing expenses.

9. Automate Bill Payments

Automating your bills can make budgeting easier by ensuring that you never miss a payment. It also helps you avoid late fees, which can add up quickly. Set up automatic payments for your rent, utilities, insurance, and other regular bills to stay on top of your finances.

10. Seek Out Community Resources

Many communities offer resources for individuals on low incomes. These resources can help you save money on groceries, medical care, and more. Here are a few resources to explore:

- Food Banks: Many local food banks provide free groceries to those in need.

- Subsidized Transportation: Some cities offer discounted or free public transportation for low-income residents.

- Health Clinics: Look for free or low-cost health services through community clinics.

Utilizing these resources can ease some of the financial burdens on your budget.

11. Find Side Hustles or Extra Income

If you’re struggling to make ends meet, finding additional income sources can be a game changer. Some options to consider include:

- Freelance Jobs: Websites like Fiverr and Upwork provide platforms to offer your skills to a global audience.

- Gig Economy Work: Ride-sharing services like Uber or food delivery services like DoorDash allow you to work on your own schedule.

- Online Surveys or Micro-Tasks: Participate in paid surveys or complete small online tasks for extra cash.

A side hustle can help supplement your income and make budgeting easier.

Conclusion: Mastering Your Finances on a Low Income

Learning how to budget money on low income can seem challenging, but it’s definitely possible with the right approach. By creating a budget, tracking your expenses, and cutting back on unnecessary costs, you can take control of your financial situation. Even with a low income, small steps toward saving, reducing debt, and planning for the future will set you on a path to financial success.

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides.