Introduction

Graduate school is an exciting but financially challenging chapter in life. It’s a time when budgeting and saving become essential skills. For students asking, “How much money should I save in grad school?” the answer depends on your unique financial circumstances. However, having a clear plan for saving, budgeting, and managing expenses can make this period much less stressful.

This guide explores practical strategies to help U.S. graduate students save money effectively while maintaining financial stability. Whether you’re living on a stipend, working part-time, or relying on student loans, these tips can help you stretch your dollars further and prepare for the future.

Table of Contents

Why Saving Money in Grad School Is Important

Saving money during grad school offers numerous benefits:

- Emergency Preparedness: Life is unpredictable, and unexpected expenses, such as medical bills or car repairs, can arise. A savings cushion provides peace of mind.

- Debt Reduction: The less you borrow, the less interest you’ll pay in the long run.

- Building Habits for the Future: Saving and budgeting now prepares you for financial success after graduation.

Even small amounts can make a significant difference over time. Let’s explore how you can save during grad school while balancing your other responsibilities.

Understanding Grad School Expenses

The first step to answering “How much money should I save in grad school?” is understanding where your money goes. Typical expenses include:

- Tuition and Fees: These vary significantly, ranging from $10,000 to $50,000 annually. Consider assistantships or tuition waivers if available.

- Housing: On-campus housing or shared apartments can lower costs.

- Books and Supplies: Explore digital resources, library rentals, or second-hand materials.

- Transportation: Costs for gas, parking, or public transit should be factored into your budget.

- Food and Groceries: Meal prepping and avoiding frequent dining out can help save hundreds annually.

- Health Insurance: Many universities offer discounted plans for students.

How Much Money Should I Save in Grad School Each Month?

The amount you save depends on your income and expenses. A good benchmark is to save 10–20% of your monthly income. For instance:

- If you earn $2,000 per month from a stipend or part-time job, aim to save $200–$400.

- If your income is irregular, focus on building an emergency fund first before committing to regular savings.

Prioritize savings for:

- Emergencies: Aim for 3–6 months’ worth of living expenses.

- Future Expenses: Plan for graduation costs, such as relocating or buying professional attire.

- Reducing Loan Dependency: Save to minimize borrowing or pay down interest.

Budgeting Tips for Grad Students

Budgeting is essential for effective savings. Here’s how to start:

- Track Every Dollar: Use budgeting apps like Mint or Excel to categorize spending.

- Plan Ahead: Allocate money for fixed expenses (rent, utilities) and variable costs (groceries, transportation).

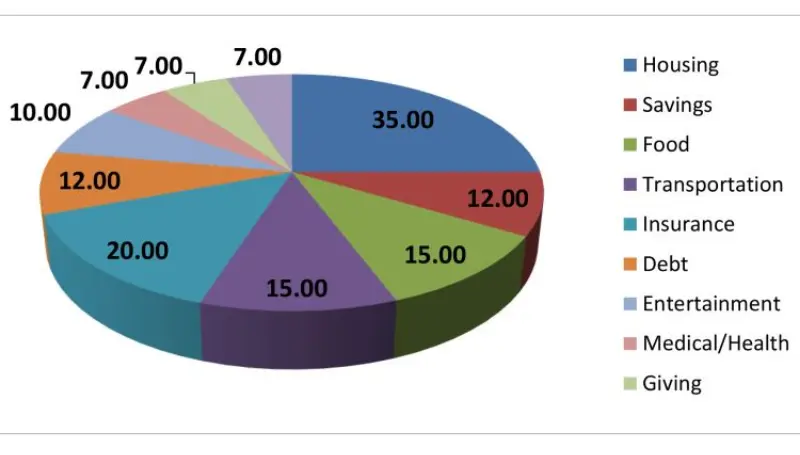

- Stick to the 50/30/20 Rule:

- 50% for necessities.

- 30% for wants.

- 20% for savings or debt repayment.

Saving on Housing Costs

Housing often consumes a large part of your budget. To save:

- Share Accommodations: Roommates can reduce rent and utility bills.

- Consider On-Campus Housing: It’s often cheaper and eliminates commuting costs.

- Live Close to Campus: Walking or biking to classes saves money on transportation.

Transportation Savings

Transportation can be a hidden expense if not managed wisely. Tips include:

- Public Transit: Many cities offer discounted student passes.

- Carpooling: Share rides with classmates to cut costs.

- Biking or Walking: These options are cost-effective and environmentally friendly.

Cutting Food and Grocery Expenses

Food expenses can quickly spiral out of control without careful planning. Here’s how to save:

- Cook in Bulk: Meal prep at the start of the week to avoid eating out.

- Use Cashback Apps: Tools like Ibotta and Rakuten provide grocery discounts.

- Buy Store Brands: Generic brands offer significant savings without compromising quality.

Leveraging Scholarships and Financial Aid

Scholarships and grants are excellent ways to reduce costs. Look for:

- Program-Specific Scholarships: Many universities offer funds for graduate students.

- Professional Associations: Many organizations offer scholarships based on your field of study.

- Assistantships: Teaching or research roles often include stipends and tuition waivers.

Don’t forget to apply for FAFSA (Free Application for Federal Student Aid) to access federal loans and grants.

Emergency Funds: Your Financial Safety Net

An emergency fund is essential to handle unexpected situations like car repairs or medical bills. Start small by saving $500, then gradually build to 3–6 months’ worth of living expenses.

Building Long-Term Financial Habits

Graduate school is an excellent time to establish habits that will benefit you throughout your life:

- Start Investing: If possible, contribute to a Roth IRA or other low-risk investments.

- Build Credit: Pay your bills on time and avoid carrying large credit card balances.

- Plan for Retirement: Even small contributions can grow significantly over time.

Using Technology to Manage Finances

Apps and online tools can simplify budgeting and saving:

- Mint: Track your spending and categorize expenses.

- Acorns: Invest spare change from purchases.

- PocketGuard: Ensure you don’t overspend.

FAQs on How Much Money Should I Save in Grad School

Q1. How much money should I save in grad school each month?

Aim to save 10–20% of your monthly income or stipend.

Q2. Can I save while paying for tuition and rent?

Yes, by creating a budget and prioritizing essential expenses.

Q3. What are the best ways to reduce grad school expenses?

Cook meals at home, apply for scholarships, and use public transit to cut costs.

Q4. Should I save for retirement during grad school?

If feasible, contribute to a Roth IRA or another retirement account.

Q5. Are there tools to help with saving?

Yes, apps like Mint, PocketGuard, and Acorns are great for managing finances.

Conclusion

Asking “How much money should I save in grad school?” is the first step to financial security during this challenging yet rewarding period. By understanding your expenses, creating a budget, and setting realistic savings goals, you can thrive academically and financially. Take control of your money today and build habits that will benefit you for years to come.

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides.