Learning how to build an emergency fund on a budget is a crucial financial skill that can transform your financial future. This comprehensive guide will show you proven strategies to build emergency fund on budget while managing your daily expenses.

Table of Contents

Why You Need to Build Emergency Fund on Budget

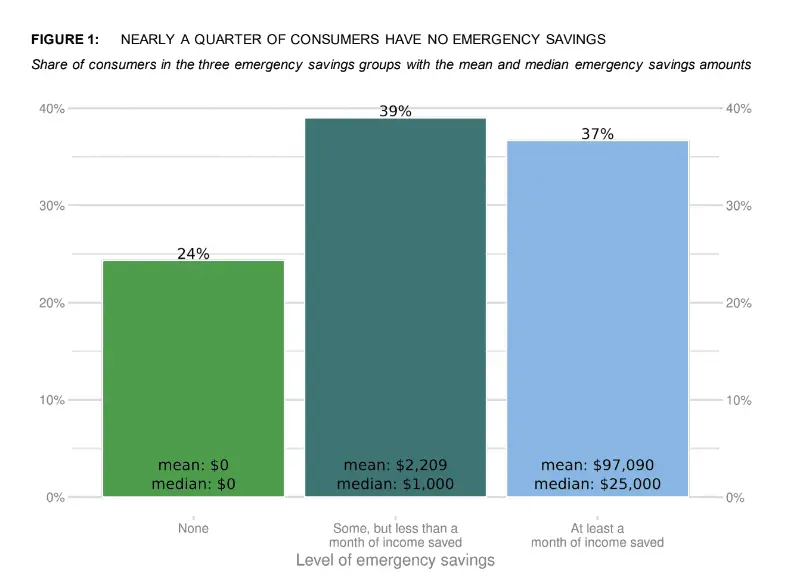

According to a 2023 Federal Reserve report, 37% of Americans would struggle to cover an unexpected $400 expense. This stark reality emphasizes why learning to build emergency fund on budget should be your top financial priority.

Understanding Emergency Fund Basics

An emergency fund serves as your financial buffer against life’s unexpected challenges. As financial expert Suze Orman explains in her blog, having dedicated savings can prevent you from falling into debt when crisis strikes.

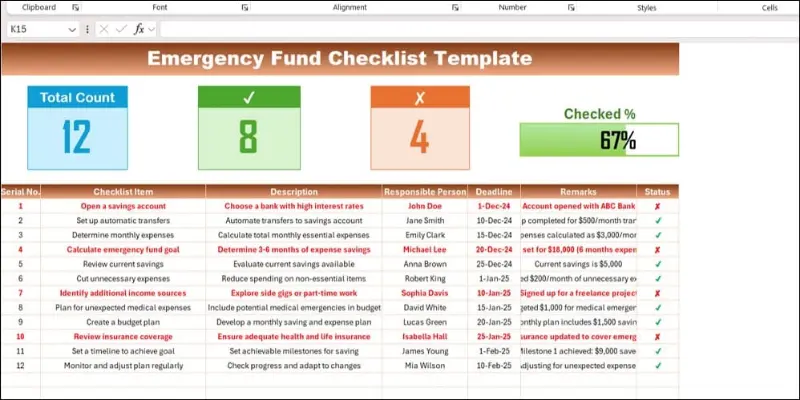

Source: https://www.pk-anexcelexpert.com/

Strategic Steps to Build Emergency Fund on Budget

1. Set Realistic Emergency Fund Goals

According to Dave Ramsey’s proven method, when you’re learning to build emergency fund on budget, start with these achievable targets:

- Initial goal: $1,000 mini emergency fund

- Secondary goal: One month of expenses

- Long-term goal: 3-6 months of expenses

2. Analyze Your Current Spending

Before implementing strategies to build emergency fund on budget, understand your money flow. The Consumer Financial Protection Bureau recommends tracking:

- Essential expenses

- Non-essential spending

- Debt payments

- Current savings

3. Uncover Hidden Savings Opportunities

To effectively build emergency fund on budget, look for savings in these areas:

Reduce Fixed Expenses

According to NerdWallet’s research, you can save significantly by:

- Negotiating better insurance rates

- Reviewing utility providers

- Auditing subscriptions

- Comparing phone plans

Optimize Variable Expenses

The Bureau of Labor Statistics shows that careful planning can reduce spending by:

- Meal planning and bulk shopping

- Using cashback apps

- Choosing generic brands

- Implementing energy-saving habits

4. Automate Your Journey to Build Emergency Fund on Budget

Make saving automatic with these proven methods:

- Set up direct deposit splitting

- Use bank round-up features

- Start with 1% automated savings

- Gradually increase contribution percentage

Advanced Strategies to Build Emergency Fund on Budget Faster

1. Generate Additional Income

The Pew Research Center suggests these methods:

- Online freelancing

- Gig economy participation

- Selling unused items

- Participating in market research

2. Maximize Your Savings Return

According to Bankrate’s analysis, optimize your returns by:

- Choosing high-yield savings accounts

- Comparing online banks

- Securing account opening bonuses

- Avoiding risky investments

Maintaining Your Emergency Fund

The FDIC’s financial education resources recommend:

- Immediate replenishment after use

- Annual target amount reviews

- Separate account management

- Regular inflation adjustments

Expert Tools and Resources

For additional guidance on how to build emergency fund on budget, consult:

Psychological Barriers to Building Emergency Funds

Understanding the mental challenges of saving helps you build emergency fund on budget more effectively. According to psychological research from the American Psychological Association, common barriers include:

Present Bias

We tend to prioritize immediate gratification over long-term security. To overcome this:

- Set specific, visual savings goals

- Track progress with apps or charts

- Reward yourself for meeting milestones

- Share goals with accountability partners

Scarcity Mindset

Financial stress can lead to poor decision-making. Combat this by:

- Breaking large goals into smaller chunks

- Focusing on daily progress

- Celebrating small wins

- Maintaining perspective on long-term benefits

Conclusion

Learning to build emergency fund on budget requires dedication and smart financial strategies. By following these expert-backed methods and maintaining consistency, you can create a robust financial safety net. Remember to review your progress regularly and adjust your approach to build emergency fund on budget as your financial situation evolves.

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides.