Being a frugal money saver doesn’t mean living in deprivation—it’s about making intentional choices to manage your finances in a smarter way. Whether you’re aiming to save for a specific goal, pay off debt, or prepare for future expenses, these strategies will help you stretch every dollar.

In this guide, you’ll learn practical steps and habits that can help you adopt a more mindful approach to spending. Ready to master your money? Let’s get started!

Table of Contents

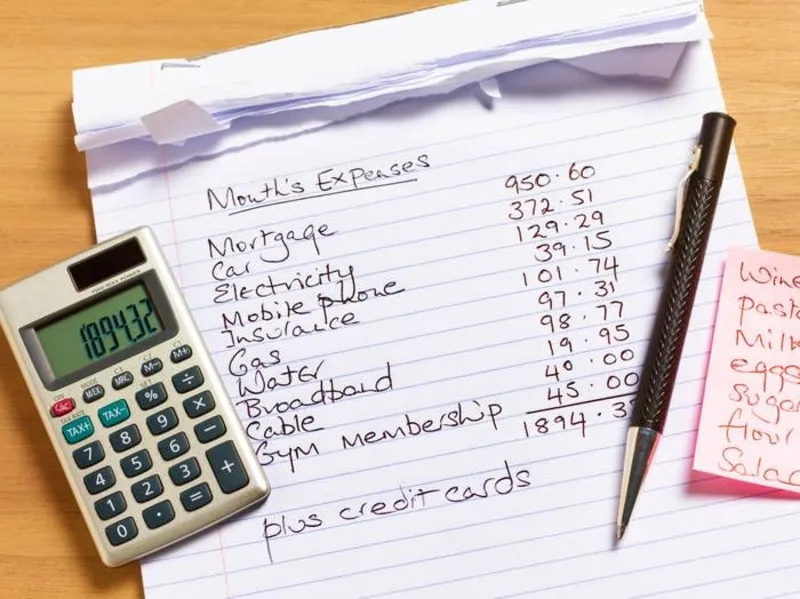

1. Track Your Spending to Identify Areas for Savings

The first step to becoming a frugal money saver is understanding where your money is going. Tracking your spending helps you identify areas where you can cut back. Use budgeting tools like Mint or YNAB (You Need a Budget), or simply keep a record on your phone or in a spreadsheet to monitor your monthly expenses.

Why Tracking is Key:

- Recognizes spending patterns.

- Identifies areas to cut unnecessary costs.

- Gives a clear picture of your financial health.

By tracking your expenses, you’ll be able to take control of your spending, a crucial part of becoming a frugal money saver.

2. Switch to a Cash-Only System for Discretionary Spending

One habit of a frugal money saver is using cash for discretionary purchases. This helps prevent overspending, as once the cash is gone, you can’t spend more.

Benefits of a Cash-Only Approach:

- Encourages careful budgeting.

- Reduces reliance on credit cards.

- Keeps you within your set limits.

Adopting a cash-only system can be a game-changer for anyone wanting to be more mindful of their spending and stay on track with their financial goals.

3. Meal Plan and Cook at Home

One of the best ways to save money is by cooking your own meals. A frugal money saver often finds that eating out adds up quickly. Meal planning and home cooking can significantly reduce food costs, and it allows you to make healthier choices.

Tips for Frugal Meal Planning:

- Plan your meals for the week and create a shopping list.

- Use leftovers for lunches or dinner the next day.

- Take advantage of discounts and store loyalty programs.

By planning your meals and cooking at home, you’ll cut down on food waste and avoid the temptation of pricey restaurants.

4. Use Coupons and Cashback Apps

Thanks to technology, it’s easier than ever to save money on everyday purchases. A frugal money saver uses tools like cashback apps (Ibotta, Rakuten) and online coupon websites (Honey) to get discounts and cash back on both in-store and online purchases.

How to Maximize Savings:

- Combine coupons with store sales for double savings.

- Use cashback apps every time you shop.

- Take advantage of loyalty programs and member discounts.

This approach ensures you’re always getting the best deal and maximizing your savings potential.

5. Cut Unnecessary Subscriptions

Monthly subscriptions can add up quickly. A frugal money saver regularly reviews their subscriptions (streaming services, gym memberships, etc.) and cancels those that aren’t providing real value.

How to Streamline Subscriptions:

- Make a list of all active subscriptions.

- Cancel those you haven’t used in the past month.

- Consider family plans to save on shared services.

Eliminating unused or unnecessary subscriptions will help you keep your budget in check.

6. Buy Used Items Instead of New

Buying used doesn’t mean sacrificing quality. A frugal money saver knows that secondhand items—whether it’s clothing, furniture, or electronics—can offer excellent value.

Where to Find Good Deals:

- Thrift stores and consignment shops.

- Online marketplaces like Facebook Marketplace, OfferUp, or Craigslist.

- Refurbished electronics from trusted retailers.

By opting for used goods, you not only save money but also contribute to sustainability.

7. Automate Your Savings

Automating your savings ensures you’re consistently setting money aside for future goals. A frugal money saver knows the importance of “paying yourself first” and making sure savings are a priority.

Ways to Automate Your Savings:

- Set up automatic transfers to a dedicated savings account.

- Use apps that round up your purchases to the nearest dollar and save the difference.

- Create a specific savings account for emergency funds or long-term goals.

Automation is a simple but effective way to make sure saving money becomes a regular habit.

8. Avoid Impulse Purchases

Impulse buying is a major roadblock for many people trying to save money. A frugal money saver avoids making spontaneous purchases by waiting at least 24 hours before buying anything that isn’t essential.

How to Curb Impulse Spending:

- Always shop with a list and stick to it.

- Unsubscribe from promotional emails and marketing notifications.

- Remove saved payment details from online stores to make checkout harder.

By exercising restraint, you’ll avoid the temptation of unnecessary purchases and stay on track with your financial goals.

9. Negotiate Your Bills

Many companies are willing to lower your bills if you simply ask. A frugal money saver negotiates regular expenses like insurance premiums, internet rates, and even medical bills to secure a better deal.

Bills You Can Negotiate:

- Cable and internet services.

- Insurance rates (car, home, health).

- Credit card interest rates.

Negotiating your bills can result in significant savings, allowing you to keep more money in your pocket.

10. Learn DIY Skills for Home Repairs

Why pay someone else to do something you can do yourself? A frugal money saver knows that learning basic DIY skills can save a lot on home repairs and improvements.

Simple DIY Projects:

- Fixing leaky faucets or clogged drains.

- Painting or updating your home’s decor.

- Assembling furniture or installing shelving.

Learning to do these tasks yourself will help you save money and feel more self-sufficient.

Frequently Asked Questions (FAQs)

Q1: What is a frugal money saver?

A frugal money saver is someone who carefully manages their finances by cutting unnecessary expenses and making intentional, money-saving choices.

Q2: How can I save money without feeling deprived?

Focus on making smart choices, like cooking at home, using cashback apps, and avoiding impulse purchases. Small changes can add up to big savings without sacrificing your lifestyle.

Q3: Are cashback apps really worth it?

Yes! Cashback apps like Rakuten and Ibotta offer real savings on purchases, making them valuable tools for any frugal money saver.

Q4: What’s the fastest way to cut monthly expenses?

Start by reviewing and cutting unnecessary subscriptions, negotiating bills, and eliminating impulse buying. These simple steps can immediately reduce your monthly expenses.

Q5: How can I make saving automatic?

Set up automatic transfers to a savings account, use apps that round up your purchases, and ensure you prioritize savings before discretionary spending.

Q6: Why is buying used better than buying new?

Buying used can save you a significant amount of money, and with platforms like eBay and Facebook Marketplace, you can often find gently used items that are in great condition.

Conclusion

Becoming a frugal money saver is about making mindful decisions that add up over time. Whether it’s through tracking spending, cutting unnecessary subscriptions, or negotiating bills, these habits can help you take control of your finances and save for the future.

Start implementing these simple strategies today, and you’ll be well on your way to becoming a more financially savvy, frugal money saver.

Explore More Tips and Insights!

Looking for more helpful articles like this one? Check out our latest posts here and stay updated with the best tips, tricks, and guides.